Six tips for finding the perfect accountant for your small business

At our Chatswood accountant firm, we regularly welcome new clients. Some have never worked with an accountant before and don’t really understand the benefits of having a financial professional on their side. Others have come to the realisation that their accountant should have been offering more value, so they make the switch.

Being in the industry for many years has helped us to identify the difference between a good accountant and a great one.

Here’s how to find the perfect accountant for your small business.

Make sure your accountant is qualified

Financial professionals have been in the news in 2021 for negative reasons. Some major stories about breaches of trust have highlighted the importance of making sure your accountant has the right licences and qualifications.

You can search the Tax Practitioners Board here: https://www.tpb.gov.au/registrations_search.

Make a connection

Your accountant should be someone you feel comfortable speaking with. Before you lock down a monthly arrangement, meet with the accountant in person or over video call to discuss your business and your goals.

A great accountant will offer more than just BAS and tax return services. You will notice when you meet that they have ideas for minimising your expenses and growing your business.

You should leave your initial meeting with your small business accountant feeling excited and confident, not confused. Excellent accountants avoid jargon so you understand what they are talking about.

Look for someone who is happy to work your way

Some accountants have clients who they never meet face to face but this doesn’t mean they don’t provide high quality service.

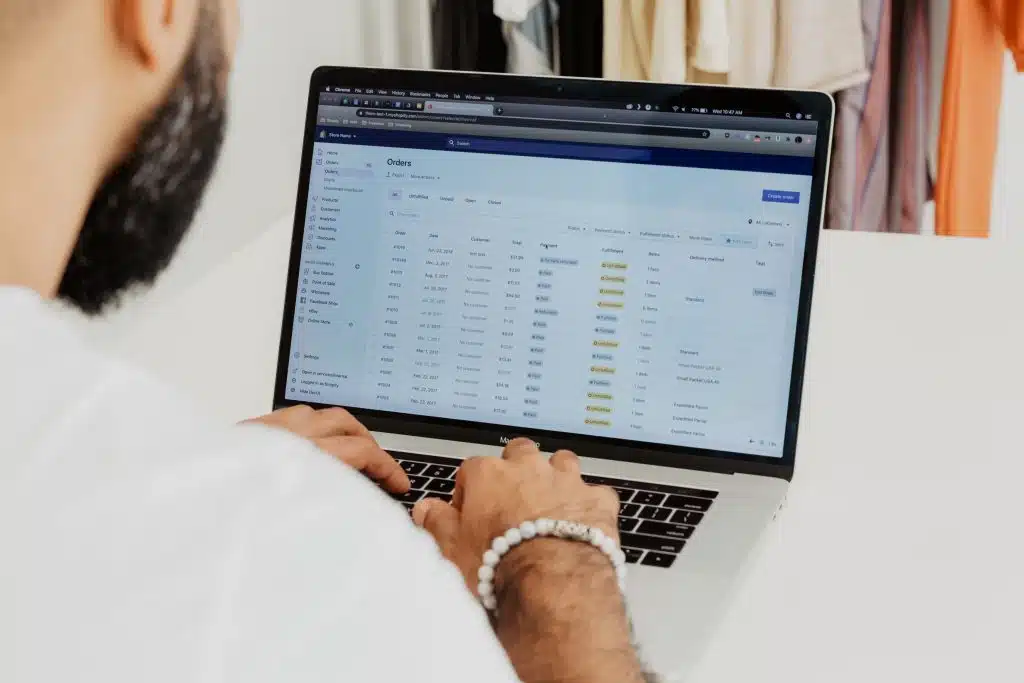

It is more than possible to have a great relationship with your accountant by working remotely. They may even be able to suggest tools that will help you to share documents and access to your accounts securely.

However, you may also wish to work with your accountant in person. If you prefer this, make it clear and check if they are happy to accommodate your needs (COVID permitting).

Find an accountant who is proactive

The bare minimum for an accountant should be to file your quarterly BAS and annual tax return.

An excellent small business accountant is your partner in success. They should be able to share stories of how they have proactively helped other clients to grow their business by helping in areas including budgeting, cash flow management and forecasting.

As an example, your accountant may sit down to prepare your tax return with you but first spend some time looking at your expenses. Working together, you can identify ways to save, either by re-negotiating with suppliers or cancelling subscriptions to services you don’t use. With some cash freed up, you can either reduce some debts or take out a strategic loan that will help your business to grow.

A proactive Chatswood accountant will also help you to stay on top of cash flow, walking you through ways to fill those gaps which inevitably happen to small business owners. Working with the Profit First system is one example, or your accountant can help you find ways to get paid on time or even up front by your suppliers.

Seek out an experienced accountant

With all the changes happening due to COVID, your business may be eligible for grants you aren’t aware of.

It can help to work with a financial professional who specialises in your industry. They will have specific insights on better ways to earn and save money. An accountant who niches may also be able to introduce you to potential partners and suppliers who will help your business to grow.

Choose a payment structure

Some accountants charge by the hour, others request a flat fee payment in return for a services package.

Having a package can make sense because you will factor your accounting fees into your budget and be more motivated to have regular contact with your Chatswood accountant.

It’s up to you which works best but you shouldn’t be paying for more than you receive.

A good accountant will pay for themselves many times over by reducing the amount of tax you owe, helping you avoid unnecessary debt and showing you smart ways to grow your profits.

Want to talk to a motivated, experienced Chatswood accountant firm that specialises in working with small businesses? Contact Imagine Accounting.