There are many different ways to structure your business; one of which is to establish a holding company.

If this term is new to you, here’s some information about how it works and why it’s a strategy that might make sense for your business.

What is a holding company?

Holding companies typically aren’t trading entities. Their purpose is usually to own (hold) shares in other companies, which are referred to as ‘subsidiaries’.

A holding company is also commonly used to hold:

- IP (trademarks, patents, goodwill)

- Cash

- Real estate

- Other investments

Holding companies are protected from liquidations or other financial woes that might affect their subsidiaries. If a subsidiary goes under, the holding company usually won’t be responsible for covering the subsidiaries liabilities.

An Australian example of a holding company is Seven Group Holdings, which has multiple subsidiaries including Coates, WesTrac and Seven Media Group.

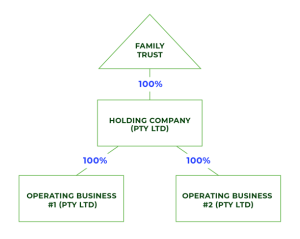

Typical Group Structure:

Should you establish a holding company?

Creating a holding company may work for your business for the following reasons:

- Protection from liability: As mentioned above, holding companies cannot be held accountable for the debts and other liabilities of their subsidiaries. This means that if a subsidiary company goes under, there is no danger to the holding company.

- Enables tax effective shifting of profits and cash from trading companies (subsidiaries) into a separate entity (ie the holding company), which results in improved asset protection

- Cheaper loans: Holding companies can have greater financial strength than their subsidiaries, and hence can potentially obtain finance at a lower cost. They can then filter the contents of the loan to a subsidiary that is in need of capital.

- Innovation: Having subsidiaries can foster innovation. Because subsidiaries are not a risk to the holding company, shareholders are less affected when a subsidiary is taking risks and pushing innovative limits.

- Free form management: For the holding company, there is no lost time in managing subsidiaries, and for the subsidiaries, the holding company does not interfere with day-to-day management.

- Asset control for less cost: A holding company only needs a controlling share in its subsidiaries, not necessarily one hundred per cent ownership. This can broaden the number of assets the company can control without extra cost.

- Opportunities for acquisitions: Your holding company may acquire shares in or ownership of businesses outside of your own.

If you’re a business owner, you may decide to set up a holding company for the above reasons or because you want to diversify and invest in new ventures without keeping all your eggs in one basket or overpaying on tax.

What are the downsides of holding companies?

A holding company may not work because of the following:

- Establishing the company and ongoing costs: Forming a holding company is complicated and requires ongoing costs to remain legally compliant. It needs to have enough subsidiaries with enough profits to justify the expense.

- Management issues: In cases where the holding company doesn’t own all of a subsidiary, there are minority shareholders to be dealt with and management issues can arise. It can also be an issue if the holding company operators lack knowledge of the sector in which the subsidiary is based.

- Complexity: As soon as a holding company enters the picture, things like accounting and tax become more complex. This doesn’t have to be a bad thing; it simply means you need the support of the right people.

Interested to switch to a holding company structure?

If your business has reached the stage where creating a holding company may make sense, please reach out. Imagine Accounting can work together with you to create a plan and get the ball rolling.

Want to know more about holding companies? Get in touch with Imagine Accounting in Chatswood today.