Having foresight over your monthly cash flow forecast is critical to the survival and success of your business. Every business owner should be asking the following questions to best understand how to do a cash flow forecast for their small business:

• “Can we pay our employees at the end of month?”

• “Do we have the cash to pay PAYG and GST at the end of the month?”

• “Can we afford to take on this new client?”

Here are 5 simple rules for cash flow forecasting:

1. Create sound assumptions

It is important that you model your cash flow using achievable and realistic assumptions. To ensure accurate forecasts, revise retrospective sales and expenses data with the to-date sales pipeline.

2. Test scenarios

Create scenarios within your forecasting tool to consider all possible situations. ‘What if’ tests covering early payment, expected sales and spikes in variable costs can give you better foresight on future events.

3. Keep it simple

A forecast can only be so accurate. You can spend time formulating a sophisticated prediction but often complexity can increase probability of errors. Simple modelling complemented by stress testing will ensure you are aware of all possible scenarios.

4. Review actual vs forecast

On a weekly basis you should be reviewing the actual figures against your assumptions and forecasts. On-going adjustment is crucial to ensure accuracy moving forward.

5. Forecast Period

The period of forecasting is generally determined by the length of your cash flow cycle. The whole purpose of this exercise is to manage short-term cash flow needs. The most important period is the one to four week period as events tomorrow and next week are going to impact your business now. The more proactive you are for this period, the more prepared you can be for dealing with cash shortfalls when things like GST, PAYG and wages are due.

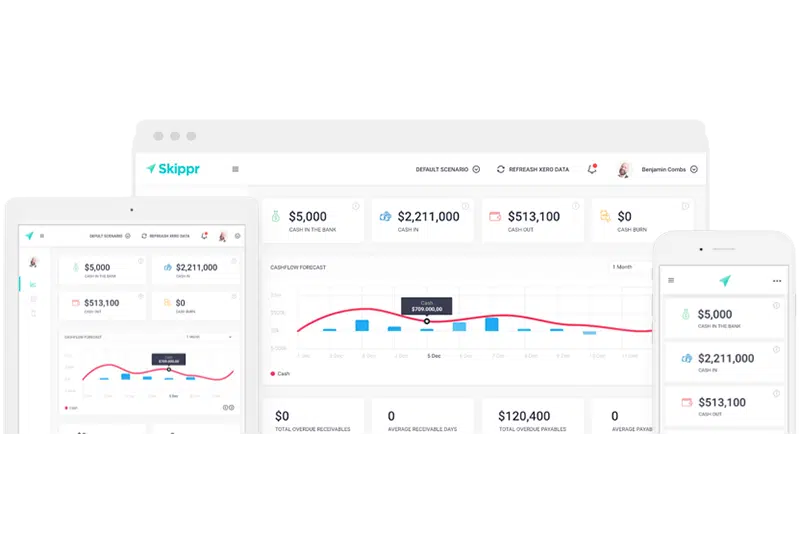

Employing these 5 simple cash flow tips into your day to day cash flow management processes will guarantee control and give you peace of mind. The time hassle of keeping this information up to date now is becoming easier with apps like Skippr.

Skippr can provide your business with live cashflow insights and forecasting, consolidated view of your entire cashflow, modelling tools, cashflow management action planner, interactive charts, pulse

check reports and alerts. It is compatible with Xero, MYOB and QuickBooks and it is free to connect to.

This blog was provided by Alistair Lamond / Co-Founder & Director Skippr www.skippr.com.au