2022 COVID advice for small business

If you run a small business and feel overwhelmed by the changing COVID-19 regulations and guidelines, you’re not alone. Repeated outbreaks have caused shifts in all aspects of society, and the business world is no exception. Instead of being like a rollercoaster, it has become something of a ghost train, with twists and turns that are impossible to predict.

As we all learn to roll with the punches, here is a helpful update sharing some of the most important things you need to know.

2022 Health rules

Most importantly, your business needs to comply with the most up to date health rules.

If your business fits into any of the following categories, you are expected to supply QR code check-ins:

- retail premises

- food and drink premises

- pubs, small bars and registered clubs

- hairdressers, spas, nail, beauty, waxing, and tanning salons, tattoo parlours and massage parlours

- gyms (except dance, yoga, pilates, gymnastics, and martial arts studios)

- hospitals (except patients of hospitals or hospitals with an electronic entry recording system that records sufficient information such that it can be used for contact tracing)

- residential care facilities or hostels (except in relation to the residents)

- places of public worship

- funeral, memorials and gatherings afterwards

- nightclubs

- casinos

- indoor music festivals with more than 1000 people.

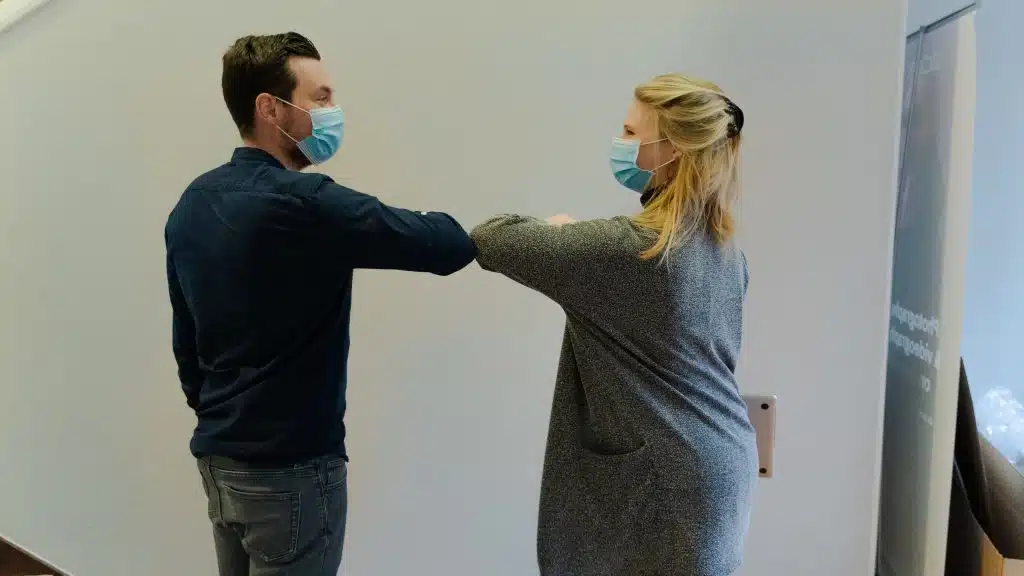

Masks also must be worn by anyone older than 12 in any indoor area not considered a private home. If you have customers or clients coming and going from your workplace, they must wear masks. Likewise, any staff working in a non-residential setting must wear a mask at all times except when eating or drinking.

This advice is applicable in February 2022, unless changes are issued.

COVID safety plan

To stay on top of rules and regulations and provide the best health and safety for your staff and clients, the government recommends creating a COVID-19 safety plan. Some businesses are legally required to make a plan, but it is worth doing for all businesses. Your plan can include the steps to take if someone tests positive for COVID, such as requesting them not to come into the office for 7 days.

The government provides industry-specific templates to make it easier to develop a COVID safety plan.

To keep your COVID safety plan up to date, you also need to keep up with changing rules. Visit government websites like the Small Business Commissioner and the business rules page, or assign a staff member to keep track of things.

Business owner Facebook groups can also be helpful if you want to be notified about changes to regulations. Don’t take people’s word as gospel but do some of your own investigating when you see new discussion threads.

Support for businesses affected by COVID

COVID-19 has hit thousands of small businesses hard. If you are struggling, it is essential to reach out for support. There are several ways to seek help:

- Government: The government has a range of grants and support available for small businesses. You can apply for the 2022 Small Business Support Program, rent relief, the small business fees and charges rebate scheme, grants for loss of perishable stock, payroll tax waivers and many more.

- Banks: The Australian Banking Association (ABA) has a national support package that has been approved by the ACCC. The package is aimed at businesses damaged by COVID-19 in 2021.

- Mental Health: Don’t neglect your mental health. There is no shame in needing help. The NSW government has a specific package to support the mental well-being of small business owners.

- Advice and training: The government does host some free training events and seminars to help you get ahead. For advice, you can contact Business Connect.

Illness

If the worst happens and you get COVID-19 or any other illness that puts you out of action, you need to have a Business Continuity Plan (BCP).

A BCP will create contingencies for sickness or any other serious incident that should strike you and your business. You can find a step-by-step guide to creating your own BCP online.

Employer obligations

As an employer, you also have an obligation to your staff. Vaccination rules and COVID-19 complications have made actions like terminating staff complicated.

You are able to ask your employees to get vaccinated, but you cannot force them to do so. For more in-depth information into workers rights during COVID-19, make sure to visit the Fair Work Ombudsman.

If you’re confused, remember Imagine Accounting can help. We work with a range of businesses and have been providing guidance for those impacted by COVID since 2020.

Need help to navigate 2022 as a small business? Contact Imagine Accounting today 02 9884 7100.